Solutions

Dynamic Discounting

A flexible solution for both Buyers and Suppliers. Efficient enough for buyers to pay their suppliers a discounted price for all purchases, and convenient enough for suppliers to take early payment before the due date in exchange for a small discount.

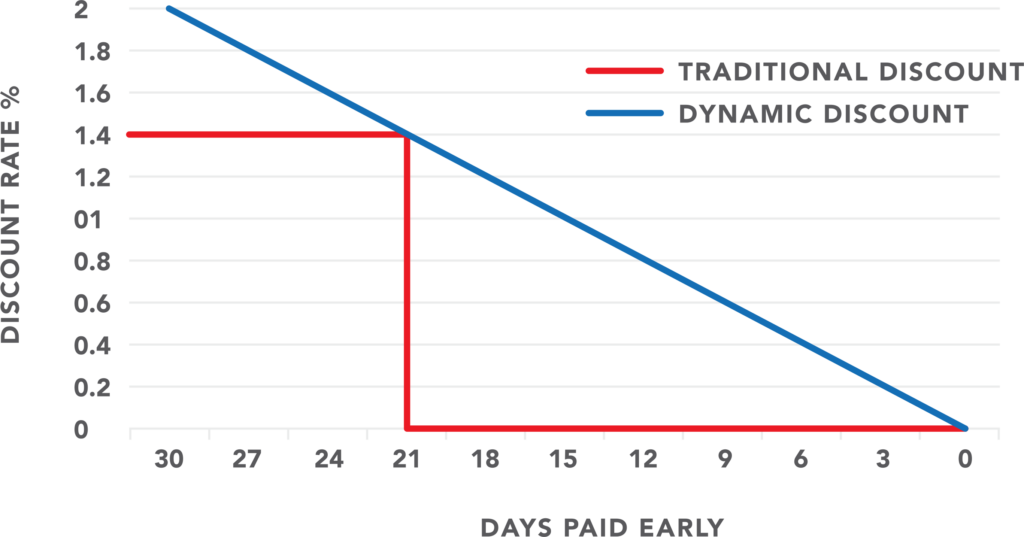

“Dynamic” word conveys the meaning of flexibility; the solution provides flexibility to suppliers for managing working capital according to their business requirements. Discount offered is directly proportional to the number of days paid early i.e., “The more days early, larger the discount.”

Companies with excess unutilized cash or unutilized limits, can deploy the capital for early payments to suppliers leading to improved gross margins (increase in EBITDA) and no risk. Buyers with cash surplus or unutilized limits should consider these alternative risk-averse avenues, especially given the recent developments in the environment, mainly the reduction on interest rates, a transition to GST, digitization and the advancement in technology adoption by Suppliers.

Algorithm-Based Auction

Xpedize Algorithm based Auction is based on weighted parameters set by Buyer to discover best value for its funds.

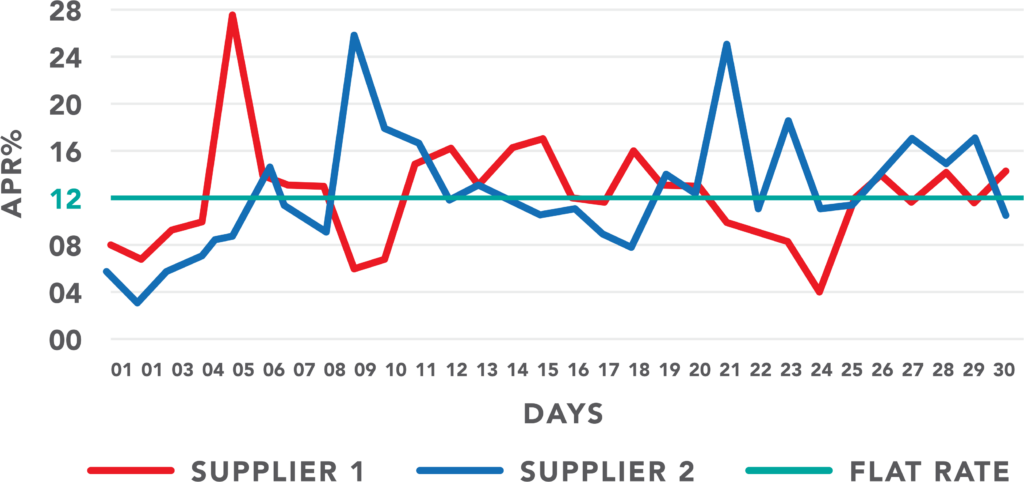

Xpedize Auction is a price discovery tool that assists the buyer in achieving strategic treasury objectives, while allowing the suppliers to freely bid /rebid on the discount that they would like to offer for getting an early payment from their respective Buyers.

During the Auction, various Suppliers raise the bids within the allotted time and an algorithm is applied to choose the bids to achieve the goal of the auction as defined by the Buyer.

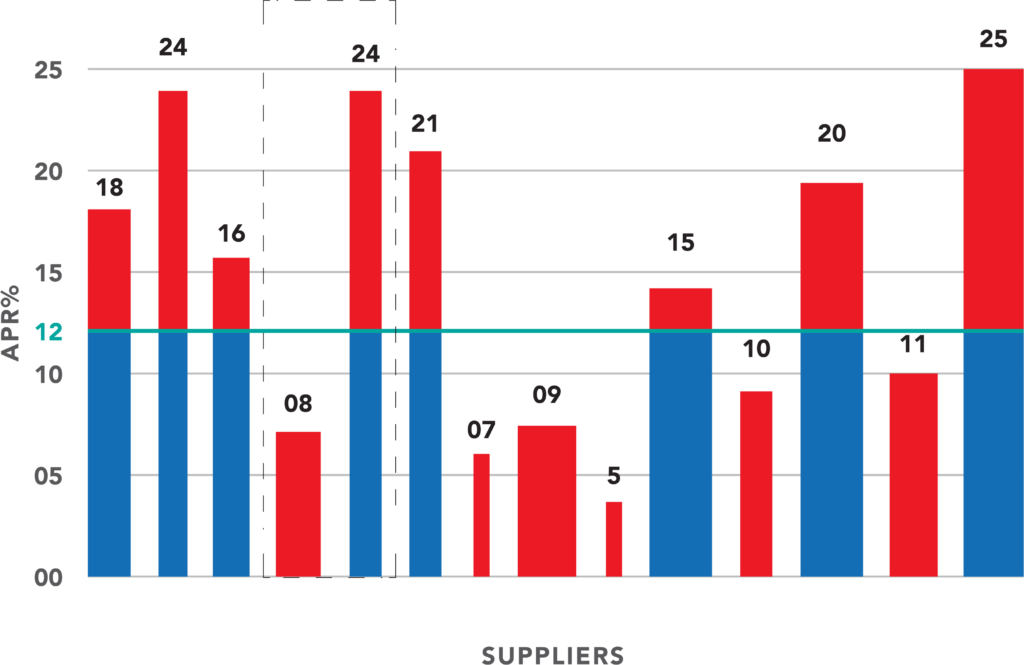

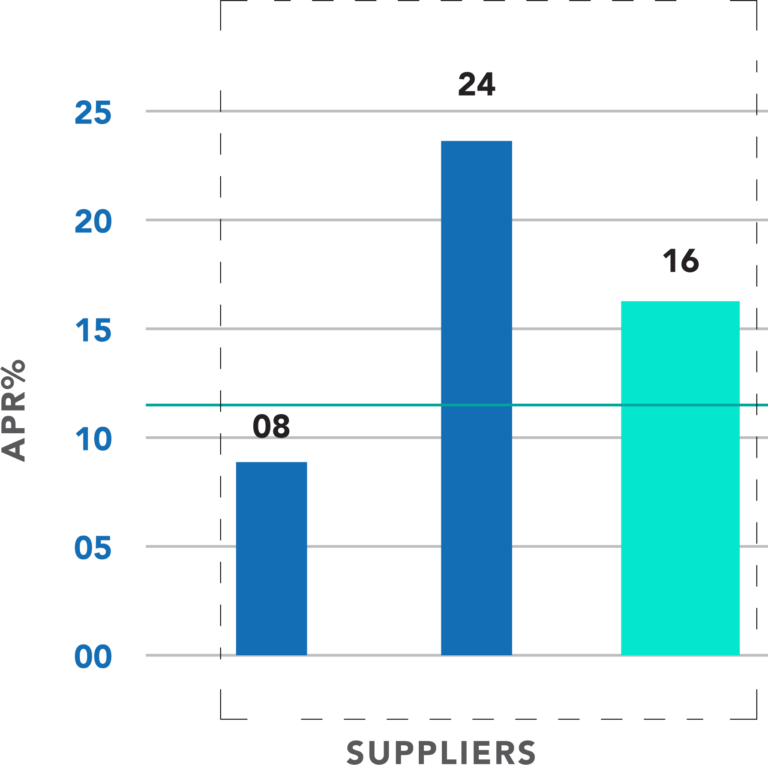

A Supplier providing 24% APR and another Supplier providing 8% APR (assuming one unit of cash each). Cumulatively, they are providing the Buyer average 16% APR for 2 units, instead of only one unit at 12% in the case of traditional discounting (since the 8% Supplier does not bid and the 24% one is brought down to the flat rate)

Xpedize Auction is an effective process that takes into account various factors effecting the buyer’s treasury and selects the appropriate bids by various suppliers.

Auctioneer (Buyer) decides a certain time, price offered for auction, and rules of the auction. Then, all selected suppliers take part in the auction and raise bids at one click. Auction is a mechanism that selects the bids based on many factors, like No. of Days Paid Early, Percentage Discount Offered, etc. with no human intervention to maximise the benefits for Buyer.

TReDS (Trade Receivables Electronic Discounting System)

Xpedize’s integration with TReDS exchanges provides an important aspect of our commitment to all Buyer Corporates, allowing them to choose TReDS as a source of competitive financing for the early payment request raised by their Micro, Small and Medium Enterprises (MSMEs) Suppliers.

TReDS is an electronic platform for discounting trade receivables of MSMEs through multiple financiers.

TReDS supports MSMEs and facilitates all transactions in a digital mode and a secure platform. TReDS registration has been made mandatory for companies with INR 500+ cr. turnover by the MSME ministry.

Bank Financing

Bank financing forms an integral part of many large corporate supply chains and the importance of relationship banks is well established given their ability to support business during crucial times.

Xpedize’s approach to integrate with relationship banks of Buyers ensures that Buyers can continue to get the same service and rates from their existing relationship bank. Xpedize has multiple banks and financial institutions participating on the platform.

Bank Financing enables corporates to finance their payments to suppliers by paying a certain interest to the Banks or setting up an off balance sheet structure .

Both Banks and Corporates benefit from the Bank Financing process on Xpedize platform.